REITs

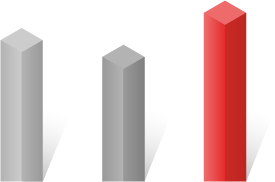

REIT AUM (Unit: KRW 100 trillion)

KORAMCO was the first company introducing REITs in Korea. Our market share has ranked at the top in the Korean REITs market for the last two decades.

Currently, KORAMCO manages approximately KRW 14.3 trillion, which corresponds to 22.3% market share in the private REIT market. We manage more than 40 landmark properties in the nation, including “The Asset Gangnam,” in Gangnam, Seoul, accommodating Samsung Fire & Marine Insurance office, and “Gran Seoul,” an office building for GS Engineering & Construction. This represents our leading position in the Korean real estate finance industry.

REIT AUM (Unit: KRW 100 trillion)

Real Estate Fund

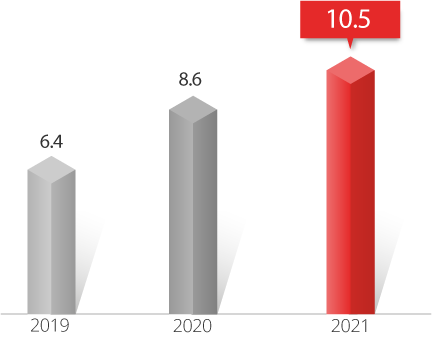

KORAMCO competitiveness lies in direct real estate investment and development projects. At present, we manage real estate investments worth KRW 10.6 trillion. Furthermore, we are improving profitability by diversifying into strategic investments (mezzanine/PEF/structured product), in addition to direct real estate investments..

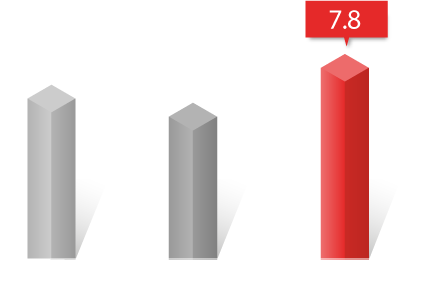

Investment Management AUM (Unit: KRW 100 trillion)

Real Estate

Trust

Real estate trust service enables land or property owners to entrust their rights to a real estate trust company in order to develop, manage or dispose of such properties for the purposes specified on their behalf. KORAMCO, offers higher profits by maximizing land value on behalf of a trustee, utilizing knowledge and experience in real estate development.

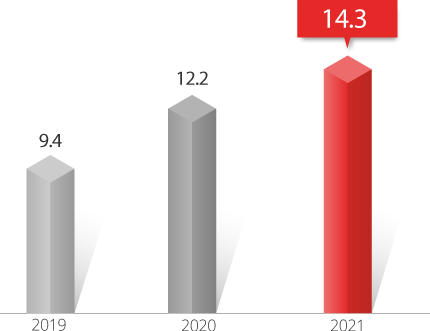

KORAMCO is one of the most stable real estate trust companies with approximately KRW 7.8 trillion in depository. We are a strong performer in the value- add and opportunistic space supported by the synergy from our 3 main business functions; REITs, Investment Management, Real Estate Trusts.

Trust depository (Unit: KRW 100 trillion)