Performance

Recent

major achievements

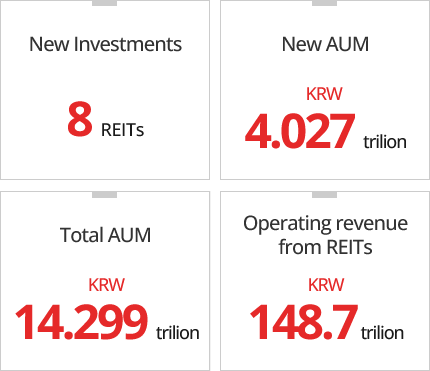

KORAMCO successfully listed KORAMCO The One REIT on the KOSPI market in March 2022. Its underlying asset is Hana Financial Investment Building, a landmark office building located in Yeouido, Seoul. With the IPO, KORAMCO became the only asset management company in Korea that manages 3 publicly traded REITs at the same time. At KORAMCO, we utilized blind funds to purchase Galleria Gwanggyo, a high-end department store, East Central Tower, a landmark located in Gangdong-gu, Seoul, and Gimpo K-Logisfield Logistics Center, further proving our status as Korea’s leading REITs management company.

We were also selected as a trust company for blind funds of national institutions, such as the National Housing Fund and the Public Officials Benefit Association. Thus, we have strengthened our position as the top real estate financial company in Korea, encompassing a wide range of services from investment in direct real estate to blind funds.

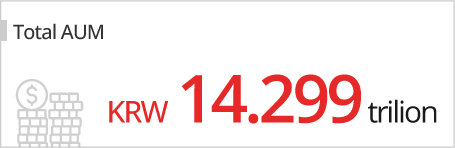

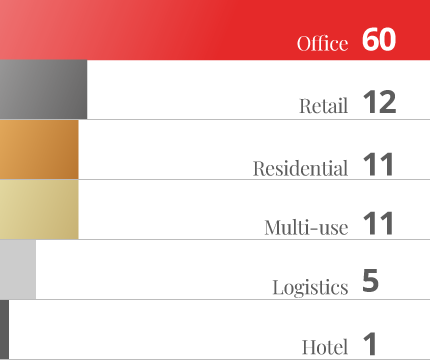

Currently, KORAMCO operates a total of 43 REITs including 7 PFVs, approximately KRW 14.2986 trillion in AUM, covering development projects, as well as investments in various sectors including offices, retail, residences, hotels.

KORAMCO is the best performing real estate financial company in the Korean private REITs market, with the total market share of 22.5%* in terms of assets under management.

Recognized blind fund operating capability

At KORAMCO, we are proactively responding to the changing capital market enviornment as we are extending our capital source from individual project basis to launching new blind fund schemes. We have raised approximately KRW 2 trillion from various types of institutional investors and government institutions, and offered returns excessing target levels.

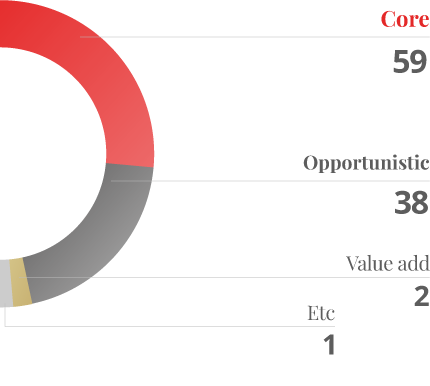

KORAMCO launched hybrid blind fund investing in Core, Value Add and Opportunistic providing solutions optimized and tailor for our customers. Moreover, KORAMCO was selected by the National Housing Fund, as the management company of the KRW 450 billion Anchor REITs. KORAMCO will do our utmost to maximize profits through keen market analyses and optimal strategies in order to live up to the confidence our investors have placed upon us.

Optimal portfolio based on the golden ratiobetween stability and profitability

KORAMCO implements diverse investment strategies based on a stable source of income in order to generate returns above investor

expectations. We maximize value by making Core investments ranging from medium-sized to trophy assets located in major hubs.

Our value-add investments mainly target underrated offices and retail properties. Our opportunistic strategy involves land acquisitions, development of logistics, mixed-use properties et cetera

thereby bringing returns beyond investors' expectations. KORAMCO has set up the optimized portfolio mixing investment sectors and assets, based on diverse investment strategies. The current portfolio, however, is based only on today, and we keep bringing it up to date every moment according to the landscape of the industry and changing market situtation.

KORAMCO has set up the optimized portfolio mixing investment sectors and assets, based on diverse investment strategies. The current portfolio, however, is based only on today, and we keep bringing it up to date every moment according to the landscape of the industry and changing market situtation.

Investiment strategy(unit: %)

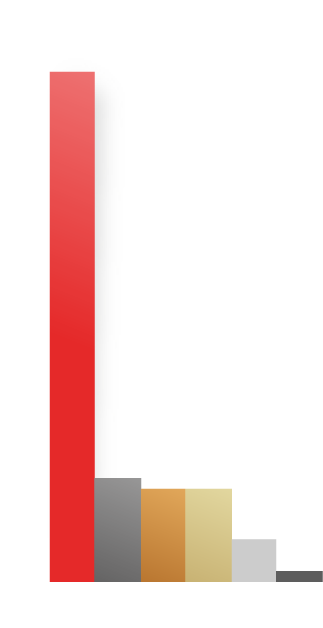

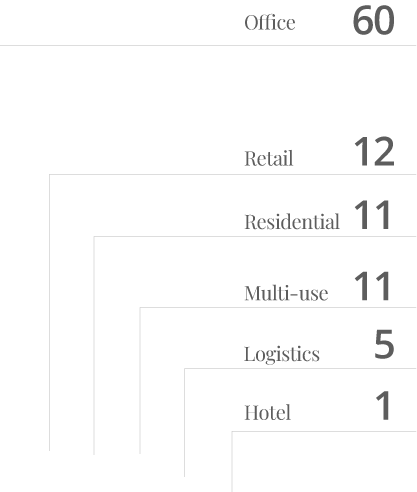

Investiment Sector(unit: %)

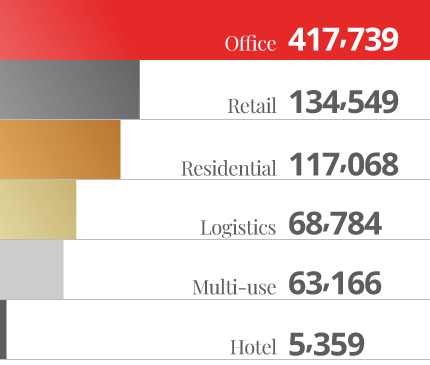

Area per asset class(unit: ㎡)