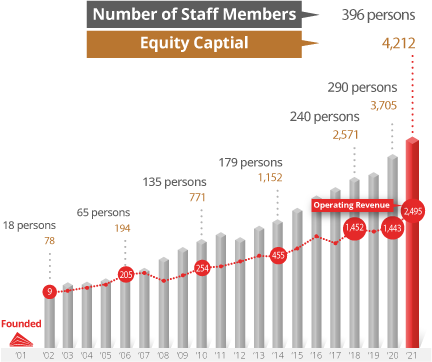

* Source : Reviewed by KORAMCO REITs & Trust Compliance

Officer No.22-0014

(Unit : KPW 100 million)

Beginning 2001-2009

2001

Founded KORAMCO

2002

Launched corporate restructuring REIT

(KOCREF No.1)

2005

Launched Korea’s first entrusted

management REIT (KOCREF No.7)

2006

Licensed for real estate trust business

2009

Licensed for redevelopment

management business

Scale Up2010-2018

2010

Licensed for debt-type land development trust Established KORAMCO Asset Management

2015

Became the first trust company to advance into housing redevelopment projects Established overseas real estate funds

2017

Scored A/Stable in corporate credit ratings

by NICE Investors Service (top score in the trust industry)

2008

Reached the accumulative real estate trust contract volume of KRW 400 billion

Leap Forward2019-

2019

Acquied by LF Group

2020

Complated 2 sites for Korea’s first trust type redevelopment Achieved KRW 4 trillion in blind funds entrusted, including National Housing Fund and Public Officials Benefit Association

2021

Reached KRW 25 trillion in REIT and real estate fund AUM Secured KRW 421.2 billion in equity capital

Company Timeline

Business Milestone

2022

Company Timeline

Participated in 2022 GRESB (Global Real Estate Sustainability Benchmark) certification

Reached KRW 100 billion in operating income

2022

Business Milestone

KORAMCO The One REIT was listed on KOSPI

KORAMCO Energy REIT carried forward the multi-use

development of Bisan Gas Station in Anyang

2021

Company Timeline

Celebrating the 20th anniversary of KORAMCO REITs & Trust

Established the ESG Committee

Reached KRW 14 trillion in REITs AUM

Secured the equity capital of KRW 421.2 billion

Ranked 1st in operating income of the 1st half year in the real estate trust industry

2021

Business Milestone

REITs

Purchased Galleria Department Store Gwanggyo

“KORAMCO Value Investment No.3-2”

Forward purchased Magok MICE CP3-2 Office

“KORAMCO Value Investment No.3-3

Purchased Gimpo K Logisfield Logistics Center

“KORAMCO Value Investment No.3-4”

Set up KORAMCO Sustainable Growth Office Blind Fund

worth KRW 300 billion

2020

Company Timeline

Selected as an asset management company for Public

Officials Benefit Association’s blind fund

Selected as an asset management company for National

Housing Fund’s anchor REIT

Announced the completion of

the project agent of Pyeongchon U’NEED, the first trust-type renewal project in

Korea

Reached KRW 11 trillion in REIT’s AUM

2020

Business Milestone

REITs

Purchased Podo Mall in Sinrim “KORAMCO Value Investment No.3-1”

Entered into a contract on the development of public housing for youth in Wonhyo-ro station influence area “LT KOCREF”

Purchased Galleria Centercity “KORAMCO Value Investment No.2-3”

Undertook the redevelopment of Emart Sangmu branch in Gwangju “KOCREF Sangmu”

2019

Company Timeline

Lee Kyuseong left office as the Chairman of the Consultative Board for Prosperous KORAMCO

Obtained the final approval for LF being the majority shareholder (Financial Services Commission)

Jeong Joonho inaugurated as the CEO and President

Reached KRW 9 trillion in REITs AUM

2019

Business Milestone

REITs

KOCREF No.48 (HJ Shipbuilding & Construction Seoul Office Building)

Value Add No.2-2 (Citibank Korea Da-dong Office Building)

KOCREF No.51 (Yeongdeungpo Time Square Office Building A and B)

LT KOCREF (2030 Public Housing for Youth in the station influence area in Wonhyo-ro 1-ga)

2018

Company Timeline

Yoon Yongro inaugurated as the Chairman

Declared the “Year of a New Leap Forward” of KORAMCO REITs & Trust

2018

Business Milestone

REITs

E REITs KOCREF Corporate Restructuring-REIT listed on KOSPI (E REITs KOCREF)

KOCREF No.43 (Samsung Seocho Office Building)

KOCREF TP (Reconstruction of Korea Teachers Pension Seoul Building)

KOCREF No.47 (KG Tower)

View More +

2017

Company Timeline

Lee Kyuseong inaugurated as the Chairman of the Board of Directors

Scored A/Stable in corporate credit ratings by NICE Investors Service

E REITs KOCREF passed the preliminary IPO eligibility review by Korea Exchange

Reached KRW 7 trillion in REITs AUM

Established KORAMCO Asset Management No.5 and No. 6 blind funds

Established 6 KORAMCO Asset Management overseas real estate funds including The Atrium in Amsterdam, the Netherlands

2017

Business Milestone

REITs

KOCREF No.36

KORAMCO Value Add Retail No.3 (subsidiary)

KORAMCO Value Add Retail No.4 (subsidiary)

KOCREF No.41

2016

Company Timeline

Awarded for the Best Real Estate Financial Company in the 1st Korea Real Estate Finance Grand Prix

Signed an MOU on “2030 Public Housing for Youth in Station Influence Area”

Established KORAMCO Asset Management No.1 and No.2 blind funds

Entered the New Stay-linked maintenance project

Reached KRW 6 trillion in REITs AUM

2016

Business Milestone

REITs

KOCREF No.31 (preferred stock)

KOCREF K-Square (preferred stock)

GS KOCREF New Stay (preferred stock)

KORAMCO Value Add Retail No.1 (parent)

View More +

2015

Company Timeline

Awarded the Model Taxpayers Award in the 49th Taxpayers Day Celebration

Established rental housing REITs

Became the first in the trust industry to engage in housing reconstruction business as a project agent

KORAMCO Asset Management licensed for hedge fund business and investment advisory business

Established 3 KORAMCO Asset Management overseas funds including US Value No.1

2015

Business Milestone

REITs

KOCREF Housing No.1 (preferred stock)-rental housing REIT

Dongtan 2 Daewoo KOCREF (preferred stock) – rental housing REIT

KOCREF No.30 (preferred stock)

Trust

View More +

2014

Company Timeline

Lee Kyuseong inaugurated as the Chairman of the Consultative Board of Prosperous KORAMCO

Lee Woocheol inaugurated as the Chairman of KORAMCO REITs & Trust

Golden Tower acquired LEED certification (KOCREF NPS No.1)

Reached KRW 5 trillion in REITs AUM

2014

Business Milestone

REITs

KOCREF The Prime (preferred stock)

KOCREF Seomyeon (preferred stock)

Parceling-out Land Trust (Wolrak-dong Public Housing in Namwon-si, Jeonbuk

2013

Company Timeline

Jeong Yongseon inaugurated as the President of KORAMCO REITs & Trust

Launched externally managed development REIT (KOCREF Gwanggyo)

KORAMCO Asset Management licensed for special asset fund business

Reached KRW 4 trillion in REITs AUM

2013

Business Milestone

REITs

KOCREF Gwanggyo

KOCREF Yangjae (preferred stock)

KOCREF Pine Avenue (preferred stock)

Trust

2012

Company Timeline

Lee Woocheol inaugurated as the Vice Chairman of KORAMCO REITs & Trust

Adopted the CRM system for stronger target marketing

Reached KRW 1 billion in cumulative social contribution

2012

Business Milestone

REITs

Established KOCREF Byukeun Hotel PFV

Trust

Parcel-out Land Trust (Apartment in Ma-dong, Gwangyang-si)

Parcel-out Land Trust (Urban-type Housing in Sinjeong-dong, Nam-gu in Ulsan)

2011

Company Timeline

Signed an agreement on cooperation with the Incheon Free Economic Zone Authority

Scored A- in corporate credit ratings (National Information and Credit Evaluation, Inc.)

Reached KRW 3 trillion in REITs AUM

2011

Business Milestone

REITs

Established KOCREF Cheongjin No.18

Established KOCREF Cheongjin No.19

Trust

Parcel-out Land Trust (Public Housing in Beomcheon-dong, Busan)

2010

Company Timeline

Founded KORAMCO Asset Management

KORAMCO Asset Management fully licensed for financial investment business and commenced business

Awarded the Model Taxpayers Award in the 44th Taxpayers Day Celebration

Licensed for debt-type land development trust

Introduced ISP (Information Strategy Planning) project

2010

Business Milestone

REITs

Established KOCREF GS Square PFV

Listed KOCREF No.15

Established KOCREF No.17

Dissolved KOCREF No.7

View More +

2009

Company Timeline

Licensed for financial investment business (trust business)

Registered for housing redevelopment business

Signed the KORAMCO-KAIST Green Smart Building Initiative

2009

Business Milestone

REITs

Dissolved KOCREF No.4

Opened KOCREF AREIF No.1, Noon Square

Opened KOCREF No.15, Times Square

Dissolve KOCREF No.5

2008

Company Timeline

Registered for housing construction business

2008

Business Milestone

REITs

KOCREF NPS No.1 merged Grace Tower

Dissolved KOCREF No.3

KOCREF NPS No.1 merged Golder Tower

Trust

Won a contract on Management-type Land Development Trust No.1 (Pangyo Business Block 3)

Parcel-out Management Trust (Sinrim-dong, Gwanak-gu in Seoul)

Reached KRW 6 trillion in trust depository

2007

Company Timeline

Created the Investigation and Analysis Team

Registered for real estate development business

2007

Business Milestone

REITs

Established KOCREF No.11

Dissolved KOCREF No.1

Established Pangyo SD-2 PFV

Established KOCREF AREIF No.1

Established KOCREF No.14

Trust

Collateral trust (Banpo-dong, Seocho-gu in Seoul)

Disposal trust (Jeongja-dong in Bundang)

Sales management trust (Minrak-dong in Busan)

Reached KRW 4 trillion in trust depository

2006

Company Timeline

Raised the capital from KRW 8.55 billion to 10 billion

Moved the head office to Hansol Building in Yeoksam-dong (Capital Tower)

Fully licensed for trust business

Reformed the Board of Directors (directors from institutional investors experts-oriented)

Selected as a trust company for the National Pension Service of Korea

Completed the development of the asset management system (KAMS)

2006

Business Milestone

REITs

Established KOCREF No.8

Established KOCREF NPS No.1

Established KOCREF NPS No.2

Reached KRW 2 trillion in REITs AUM (2.4031 trillion)

Trust

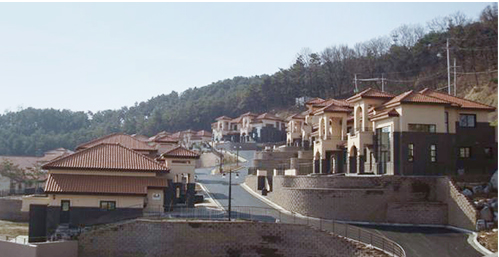

Sales management trust (Townhouse in Anseong-si)

Reached KRW 1 trillion in trust depository

2005

Company Timeline

Reached KRW 1 trillion in REITs AUM (1.0282 trillion)

2005

Business Milestone

REITs

Established/listed KOCREF No.7

Established KOCREF No.6

Dissolved KOCREF No.2

2004

2004

Business Milestone

REITs

Established KOCREF No.4

Established KOCREF No.5

2003

Company Timeline

Lee Kyuseong inaugurated as the Chairman

2003

Business Milestone

REITs

Established/listed KOCREF No.3

2002

Company Timeline

Finalized KORAMCO CI

Raised the capital from KRW 7 billion to 8.55 billion

Moved the head office to Hanhwa Securities Building (Yeouido)

2002

Business Milestone

REITs

Established/listed KOCREF No.1

Established/listed KOCREF No.2

2001

Company Timeline

Held the general meeting of promoters

Established the articles of association

Set up a preparation committee and a secretariat for the establishment of the company

Established KORAMCO

Approved as an asset management company (AMC) by the Ministry of Construction and Transportation

2001