Investment Target

Direct Real Estate

Acquisition and sale of real estate Development of real estate Refurbishment/repositioning Leasing

Real Estate-related Right

Real estate-related rights such as surface right, easement, right to lease on a deposit basis, right of lease and right of lot-out Real estate-backed monetary claim for which a financial institution is a creditor

Direct Real Estate

Securities, collective investments (fund) or asset-backed securities investing 50% or more in any of real estate, real estate-related right or real estate-backed monetary claim

Stocks issued by REIT

Stocks issued by a project financing vehicle (PFV)

Equity securities issued by a real estate special purpose company (SPC)

Derivatives that have real estate as an underlying asset

Loan to a legal entity related to real estate development, etc.

Hybrid Asset (Multi asset)

Alternative investments(real estate, infrastructure, development project)

Traditional asset (IPO shares, block deal, publicly traded REITs on the Korean and foreign stock market)

Strategic asset (PEF, VC, mezzanine, structured product)

Investment Considerations

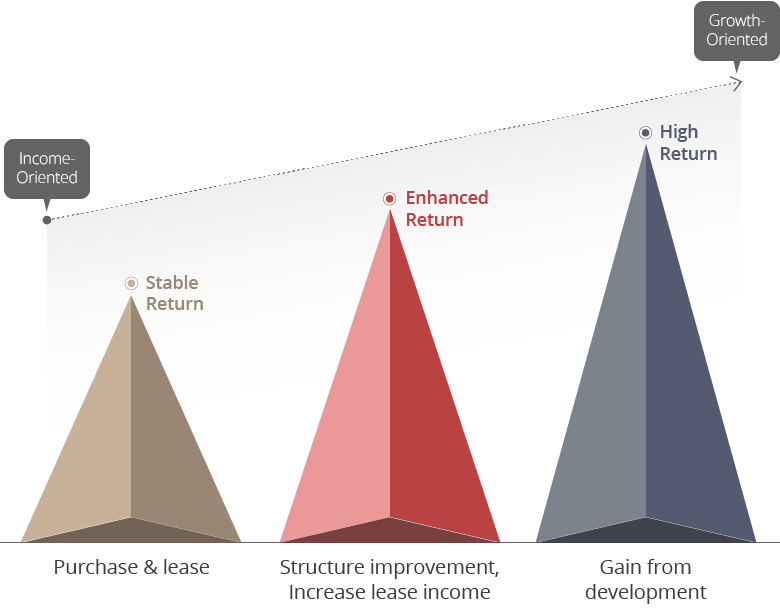

Profit maximization through diversified investment models and risk management

The ultimate goal of KORAMCO real estate funds is to maximize returns for our investors by generating stable and continuous profits.

We strive to seek a profit model that stands out from others, such as direct acquisitions, development of derivative-types and securities- type investment, and at the same time proactively managing risk.

Expansion of

high-return products

based on stability

We put stable return first, to which we also apply differentiated strategies in order to gradually increase additional returns.

We analyze correlations between risks and expected return, thereby designing the optimal investment structure for each individual projects.