Performance

Recent

major achievements

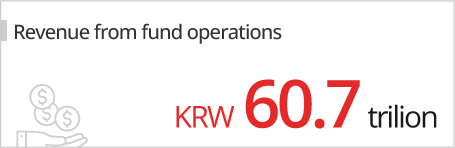

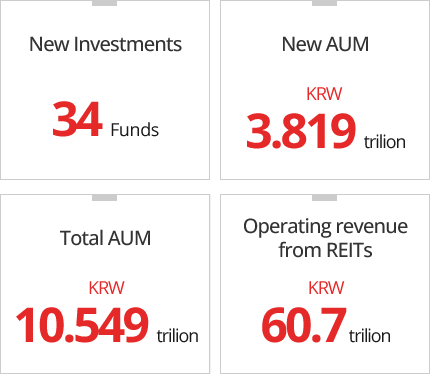

The domestic real estate fund market* grew 18.5% in 2021 compared to the previous year. The total assets under management stood at KRW 134 trillion, a KRW 20.9 trillion increase from KRW 113.1 trillion in the previous year. In terms of the number of funds, 2,296 funds are in operation, 8.3% up from 2,116 funds in the previous year. The net asset growth rate is higher compared to the number of funds established because the value of individual asset has increased. This tendency is expected to continue in line with increase in value of commercial real estate properties.

KORAMCO Asset Management established 34 new funds last year to make new investments worth KRW 3.82 trillion. Total AUM is at KRW 10.55 trillion, which was 26% up from the previous year and more than double the average growth rate of the domestic real estate funds.

Proactive investment in

industrial assets with upside

At KORAMCO, we are expanding our focus from offices to acquisitions in industrial properiteis with upside potential, such as logistics centers and data centers where an increased demand is expected in the future.

We undertook the development project of Gasan-dong IDC (Internet Data Center) valued at KRW 480 billion last year, and are currently under discussion on the additional development of IDCs in the capital area and in other promising areas.

At the same time, we have taken the lead in investing in prospective assets with huge upside potential in the future by setting up seven logistic funds, including JW Logistics Center in Hwaseong-si and Logistics Center in Sejong-si.

Active expansion of overseas business

KORAMCO expanded the overseas investments to a total of KRW 4.57 trillion by setting up 12 new overseas real estate funds to secure KRW 1.5 trillion in new asset under management (AUM). This amounts to almost half of KORAMCO real estate AUM, making overseas business fully established as a major pillar of our growth.

Especially, we are building a diversified portfolio in the overseas business, such as direct acquisitions, investments in fund of funds operated by foreign top-tier managers, and to launching blind funds.

Launching the first IPO REITs Blind Fund in Korea

KORAMCO developed “Pre-IPO REIT Blind Fund,” a new type of investment product that combines investments in direct real estate assets where KORAMCO’s biggest strength lies, and in stocks and bonds. Pre-IPO REITs Blind Fund proactively invests in REITs preparing for the initial public offering.

It is a medium-risk return instrument based on the stability of real estate investment that can offer continuous dividends and returns in line with the stock price growth. Currently, KORAMCO operates assets worth a total of KRW 530 billion through a series of 20 Pre-IPO Blind Funds.